General Rate Increases (GRIs) can be confusing across modes, especially for less-than-truckload. Below outlines why and how carriers impost GRIs, what a GRI will impact, and how to mitigate the impact of a GRI.

In Summary:

- General Rate Increases (GRIs) are how LTL carriers adjust their prices to keep up with inflationary pressures like labor, fuel, and equipment costs.

- LTL GRIs are typically announced in Q4 or Q1, and the publicly traded or larger carriers typically start the announcements.

- For many shippers, these increases can feel like an unavoidable hit.

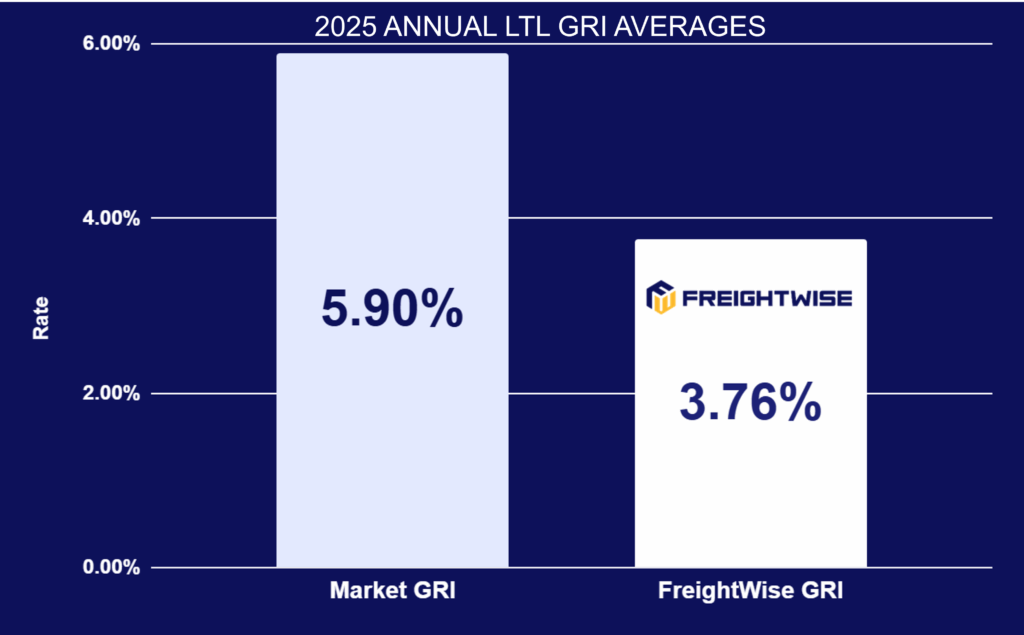

- At FreightWise, we leverage our aggregate spend and our relationships with carriers to help soften the blow. The result? In 2025, the average less-than-truckload GRI was 5.76% and for FreightWise customers it was 3.9%.

What is a Less-than-Truckload General Rate Increase (GRI), and why does it matter?

Carriers use GRIs as their main tool to adjust shipping rates in response to rising operational costs. These inflationary pressures come from several sources:

- Labor: Wages for drivers, maintenance crew, administrative staff, and other essential roles often rise to retain a skilled workforce—especially with the ongoing driver shortage. This drives up costs that carriers must pass on.

- Fuel: Diesel prices fluctuate, pushing carriers to adjust rates to stay profitable.

- Real Estate: Complex terminals and service centers require significant investments, including dock space, offices, IT infrastructure, and more.

- Equipment: Trucks, forklifts, and machinery depreciate or need upgrades. Balancing new purchases vs. aging fleets impacts fuel efficiency, maintenance costs, and safety.

- Capital Intensive Projects: Expanding networks into new regions demands upfront investments in real estate, equipment, and labor.

- Regulatory Compliance: Government mandates imposed on carriers. Examples include Electronic Logging Devices (ELDs), hours of service, and other things that require carriers costs to rise.

Without GRIs, carriers would be forced to absorb these rising costs, threatening their profitability and ability to provide reliable service.

When and how are GRIs announced?

Typically, the larger/publicly traded carriers announce their GRIs in late Q4 or early Q1. Then the remaining carriers announce theirs, all miraculously staying within a point or two of each other. These are typically announced through their websites, or communications if you are a user of that carrier.

Here are some example announcements:

How are LTL rates structured?

Before you can understand how the GRI might impact your LTL costs, you need to know how LTL rates are structured. LTL shipping rates generally have three components:

- LTL base rate: This is the list price of the shipment. It takes into consideration, the weight of this shipment, distance of the shipment, freight class, lane volume or capacity at that time.

- Fuel surcharge: Fuel surcharges are to help offset fluctuating diesel prices. These are based on weekly changes to diesel prices.

- Accessorial charges: This is any additional cost that might be associated with your delivery. Some of the most common are residential delivery, if your shipment requires a liftgate, oversize fees, etc.

For parcel and LTL modes specifically, rates are based on published rate bases, GRIs adjust these base rates. In contrast, truckload, ocean, air, and expedited freight tend to use lane- or region-specific pricing models, so GRIs don’t impact them the same way.

How do GRIs impact your LTL shipping costs?

Most often, GRIs apply to the base rates only. Carriers will sometimes call fuel and accessorial fees separately.

Why carriers might announce more than one GRI in a year?

Multiple GRIs in one year can happen due to various factors:

- Shifts in inflationary costs requiring realignment

- Balancing network flows: If a carrier starts to see that there is a ton of volume in a specific region, they may impose a GRI to try and balance some of the network volume.

- Responding to weaker financial performance (especially for publicly traded carriers)

- Correcting underestimates from previous GRIs

Each Carrier Has Its Own Rate Base

Carriers maintain their own rate bases, and the GRI percentage increases adjust these individually. For many shippers—especially small and midsize businesses—this means navigating a patchwork of rate bases and increases across your carrier portfolio. Here is a helpful blog from FreightWise to better understand rate bases.

How FreightWise mitigates the impact of LTL GRIs?

- Consolidating rate bases for all carriers: Czarlite 2012. We level the playing field by contracting all carriers onto a single, unified rate base rather than letting each carrier use their own. This simplifies your pricing landscape and prevents carriers from applying separate, potentially higher GRIs.

- Limiting GRIs to once per year. If you work directly with carriers, they may impose frequent rate bumps. Our supply chain team works directly with the carriers to enforce only one General Rate Increase annually. This gives you pricing stability and predictable budget planning.

- Holding the line on rate bases. When carriers announce GRIs on their own rate base, we hold firm since all carriers under FreightWise use Czarlite 2012. Carriers may analyze the impact on this rate base and occasionally request increases, but that’s when our negotiation power kicks in. Our Supply Chain team negotiates fiercely, leveraging competition among carriers to protect your rates. For an individual shipper you may not have the resources or carrier knowledge to know what a “good” rate is, but we do across our hundreds of shippers and thousands of carrier contracts.

- Filling the gap for small and midsize shippers. Most smaller shippers don’t have the IT infrastructure, capital, or expertise to manage a single rate base over multiple carriers. Without FreightWise, each new GRI means a higher rate on that carrier’s rate base and no effective way to push back. We bring you scale, technology, and knowledge.

The FreightWise Advantage: Your Trusted Partner in Navigating GRIs

We’re committed to simplifying your freight management while delivering cost savings and predictability. Our approach takes the complexity of fragmented rate bases and continuous carrier increases and turns it into a manageable, optimized shipping strategy.

That means fewer surprises, more buying power, and healthier margins—all the things your business needs to succeed.

Ready to see how FreightWise can help you mitigate the impact of GRIs and optimize your LTL shipping? Contact us for a free LTL assessment.